Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

Market Commentary (Hong Kong)

For the week ending 28 July 2023

The Fed hiked rates again by 25 basis points as expected, says there’s more; ECB hiked 25 basis points as well. BOJ did not hike rates but will resort to adjusting yield control curve; market followed with 300-pip whipsaw. Gold is down slightly this week but Brent Crude and WTI gains. USDHKD fell below the 7.8 midpoint of Linked Exchange Rate System.

● Japanese export controls on 23 crucial chip manufacturing items took effect; China may apply countermeasures.

● BRICS will discuss dollar alternatives at the forthcoming August summit.

● Chinese regulators met with global investors including Temasek and GIC to address concerns.

● Hong Kong sought support from Indonesia, Malaysia and Singapore for entry into RCEP.

● China and Hong Kong stocks surged after Politburo signaled support.

● China’s smartphone sales slid 2.1% in the second quarter this year..

● Singapore Airlines’ Q1 net profit up 98.4% yoy.

● China’s gaming industry sales increased 22% in H1 compared to the previous half.

● China to boost light industries in a 2-year action plan with participation from three ministries.

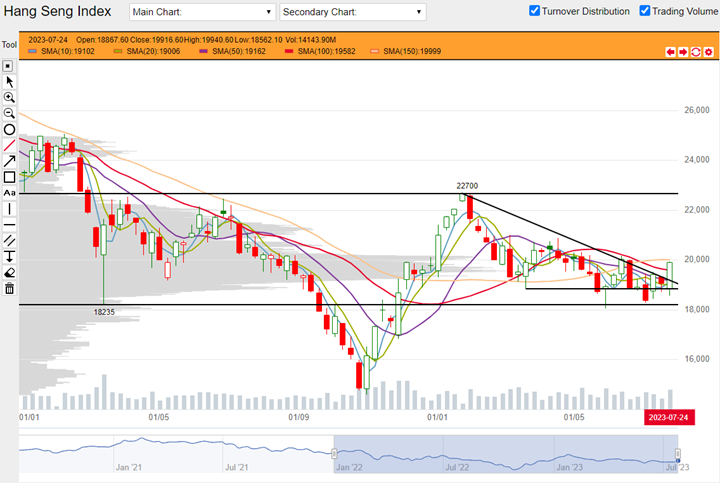

Hang Seng Index closed this week at 19414, up 1048 points or 5.71%. This week’s price action was a big bullish expansion that made a new 5-week high. This high close also appears to break a downward trendline decisively. The key driver was a signal from China’s politburo that strengthened investor sentiment. With the triangle feature appearing to be decisively broken, investors might expect HSI to test the upside. If the index complies with a larger horizontal channel that was developing since 2022, then possible support remains between 18000 until Q1-low and possible resistance to be as high as 22700-23000. Short term 10 and 20 Day SMAs made a golden cross early this week.

HSI weekly chart from 03 January 2022 to 28 July 2023 (Source: DLC.socgen.com)

Hang Seng Tech closed the week at 4467, up 362 points or 8.83%. HSTech’s chart has a high resemblance with HSI’s. The main feature common to both is a horizontal channel extending way back to 2022. The lower bound of this channel for HSTech is 3800-4000 while the higher bound is 4800-5000. Using this channel as a guide, HSTech appears to be stronger than HSI as the former’s rally is now pass the halfway mark.

HSTech weekly chart from 03 January 2022 to 28 July 2023 (Source: DLC.socgen.com)

Dow Jones Industrial Average closed at 35459, up 232 points or 0.66%. Nasdaq closed at 15751, up 325 points or 2.11%. The Dow made a new year-to-date high early week but faltered late-week. Both indices are trading above their entire basket of moving averages. This is a setup associated with further gains.

The next FOMC meeting is scheduled on 20 September 2023.

Fed funds futures on rate hike probability by next Fed meeting as at this week’s close:

● 80.0% probability of no change | 20.0% probability of 25 basis points hike

Data indicates a peak rate of 6.00% until June 2024. A rate cut could appear as early as December.

Shanghai Composite closed at 3276, up 108 points or 3.42%. Shenzhen closed at 11100, up 290 points or 2.68%. The Shanghai Index printed a big bullish expansion week that closed at a 9-week high. It also closed above its entire basket of moving averages which is a setup associated with further gains. Shenzhen closed near to a 4-week high; Shenzhen is still trading below its 100 and 150 Day SMAs.

Economic data in coming week:

1. Monday 31 July 2023 China reports Manufacturing PMI.

2. Tuesday 01 August 2023 US reports ISM Manufacturing PMI and JOLTS Job Openings.

3. Wednesday 02 August 2023 US reports ADP Non-Farm Employment Change.

4. Thursday 03 August 2023 BOE official bank rate and monetary policy report.

5. Thursday 03 August 2023 US reports Unemployment Claims, ISM Services PMI.

6. Friday 04 August 2023 US reports Average Hourly Earnings and Non-Farm Payrolls.

Other news:

● AIA bought back shares.

● Netease and CNOOC made new 52-week high.

● Geely CEO Li appointed to Aston Martin board; Geely is third largest shareholder of the luxury maker.

● Ant Group will apply for a financial holding license in China as a prelude to listing in HK; blockchain, database management and other non-core business will not be included in the financial entity.

● Volkswagen will take a 4.99% stake in Xpeng as part of a deal to manufacture two EVs for China.

● Ganfeng Lithium plans to acquire a controlling stake in a Inner Mongolia miner.

Technical observations

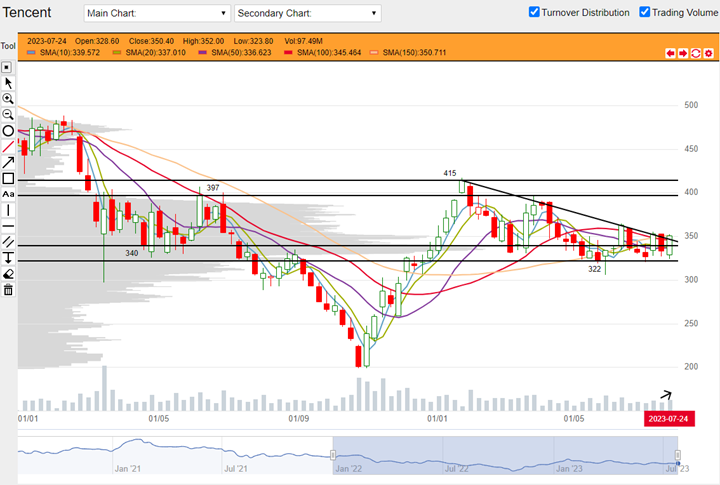

Tencent 700.hk perched at resistance, rising on higher volume.

Note chart features:

1. Tencent shares a similar setup as HSI - big horizontal channel spanning from 2022 till date and a downward trendline that is pushing price into a squeeze near the apex. HSI has broken its trendline so the key question for investors: will identical setups produce identical results?

2. Rising volume is a boon in this setup and should always be looked out for in a virtuous kind of breakout. Price is now trading above its entire basket of moving averages. This is a setup associated with further gains. If all features are still valid, price could test previous swing high are $400 region.

Tencent 700.hk weekly chart from 03 Jan 2022 to 28 July 2023 (Source: DLC.socgen.com)

Underlying Index/Stock |

Underlying Chg (%)1 |

Long DLC (Bid Change%2) |

Short DLC (Bid Change%2) |

|---|---|---|---|

| Hang Seng Index (HSI) | +0.40% | B00W (+0.86%) | VXRW (-0.35%) |

| Hang Seng TECH Index (HSTECH) | -0.93% | YPCW (-6.25%) | Y9GW (+2.07%) |

| Tencent (0700.HK) | -0.68% | ZS6W (-1.66%) | 9VHW (+1.97%) |

Brought to you by SG DLC Team

This advertisement has not been reviewed by the Monetary Authority of Singapore. This advertisement is distributed by Société Générale, Singapore Branch. This advertisement does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

Full Disclaimer - here